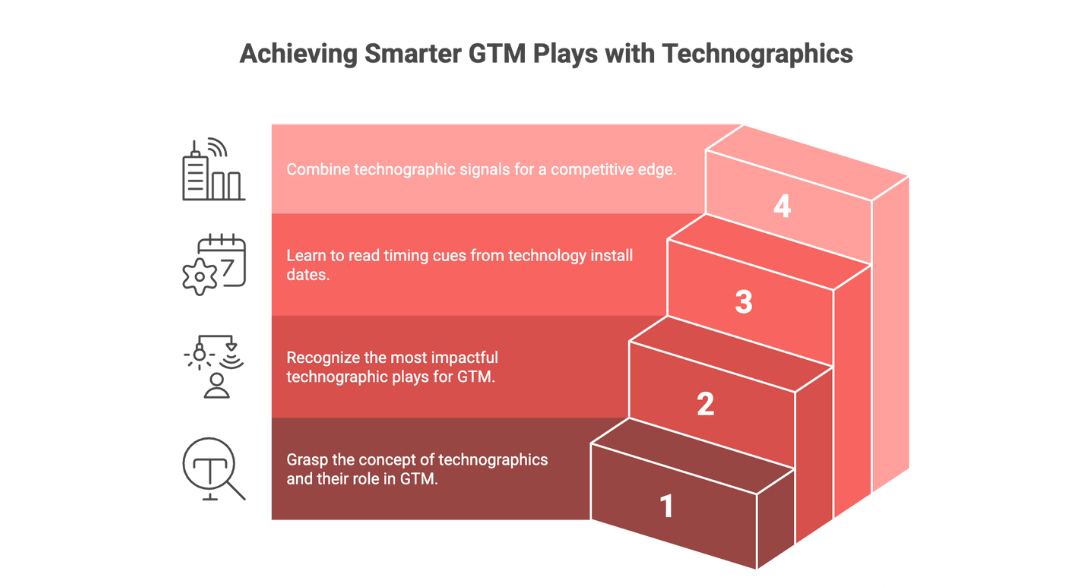

Technographic are one of the most underused outbound signal. And elite teams are winning with it You know why? Because outbound Isn’t Blind Anymore. Outbound teams have gotten sharper over the years. They’ve moved beyond just firmographics—industry, headcount, region—to using intent data, job change signals, and funding events. But one of the most underutilized levers in GTM execution is technographics: the actual tech stack your buyer uses. The stack isn’t just a set of tools. It’s a proxy for workflow, maturity, buying intent, and timing. When a company buys Salesforce, that decision kicks off a chain of new needs—RevOps support, enablement tools, integrations, coaching layers. The tech you see gives you a front-row view into what they’ll likely need next. This piece breaks down the five highest-signal technographic plays, how to read timing from install dates, and why stacking these signals gives your outbound team a compound advantage.

Why Tech Stack Is the Strongest Proxy for Buyer Maturity and Intent

The tools a company uses reflect its process depth, pain points, and functional priorities. You can tell a lot about a company just by seeing their CRM, messaging platform, and data tools. Salesforce = maturity, standardization, multi-function GTM. HubSpot = early-stage or marketing-led GTM. Mixpanel + Segment = product analytics motion. Amplitude + Snowflake = data-heavy growth motion. It’s not just what tools they use, it’s what phase they’re in. If they just adopted HubSpot, they likely need onboarding help, RevOps guidance, and top-of-funnel performance testing. If they’ve had Gong for a year, you can time your sales coaching or enablement product pitch 60 days before their renewal. The tech stack becomes a map of future GTM purchases. It shows what the buyer values, where they’re stuck, and how you can fit in.

Ecosystem Timing = Opportunity Windows

Most SaaS purchases trigger a second wave of buying needs. Once a company adopts a major platform, it doesn’t stop there. It goes looking for tools to integrate, extend, optimize, and support that platform. Example: a company implements Outreach. That unlocks downstream needs like:

- Data enrichment tools

- Onboarding and enablement support

- Reporting layers to track rep behavior

- Integrations with CRM and call coaching tools

These are ecosystem opportunities. You’re not selling a standalone product. You’re solving the second- or third-order problems that arise from earlier tech decisions. That’s why technographics give you contextual precision. They help you time your message not by arbitrary lead scores, but by the real evolution of the buyer’s workflow.

The Top 5 Technographic Plays That Actually Convert

A. Integration Play

Integration plays are ideal when your product’s value depends on what the customer is already using. This play targets companies that just added foundational platforms like Salesforce or HubSpot. These customers are actively configuring their stack and open to tools that extend the core functionality. Your messaging should focus on amplification; for example, how your product makes their new investment smarter, more actionable, or better integrated across workflows. Example: syncing HubSpot with Slack for real-time routing and visibility can resonate deeply with a team scaling lead ops.

- Best for: Products that extend or activate existing platforms.

- Trigger: Buyer recently implemented tools like Salesforce, HubSpot, Amplitude, Greenhouse.

- Message: “We activate the data you’re already collecting in [platform] to drive [outcome].”

B. Replacement / Competitor Takeout Play

If you’re going after legacy platforms or category incumbents, technographics help you spot when the timing is right. A company running on Marketo or Drift likely has years of workflows built around them. And pain points they’ve learned to live with. That’s your angle. Your message should speak to what they’re tolerating: slow UX, brittle integrations, high cost. If you know their install date, get in 60 days before renewal and frame the conversation around ROI, performance, and switching ease. It’s not just about being better: it’s about solving the fatigue of staying where they are.

- Best for: Tools that outperform, undercut, or disrupt legacy vendors.

- Trigger: Account is still running on incumbents like Marketo, Drift, Pipedrive, or Outreach.

- Message: “Still using [X]? We’re seeing teams switch because of [specific pain] and [specific gain].”

C. Maturity Play

Some companies don’t need education. They need optimization. When you see a stack with Snowflake, dbt, and Looker, you’re looking at a team with strong infra and high standards. You won’t win with shallow claims. But you can win by mapping exactly where your solution fits. Instead of pitching a dashboard, you pitch governance. Instead of pitching visibility, you pitch rollback and audit trails. This play is about fluency: showing the buyer you speak the same language and can go deep.

- Best for: Advanced products requiring sophisticated infra or process.

- Trigger: Stack includes Snowflake, dbt, Looker, Databricks.

- Message: “Looks like you’ve already built a strong infra layer. We sit on top to bring observability and control across [workflow or vertical].”

D. Workflow Play

These plays are rooted in how teams actually do their jobs. If a company uses Greenhouse and Slack, chances are they’re running hiring processes via Slack alerts and approval chains. If they use Intercom and Notion, support and documentation workflows likely overlap. You’re not pitching features:you’re pitching efficiency. Map out the day-to-day motion your buyer is in and show how you reduce toggling, speed up feedback loops, or eliminate redundant steps. It’s operational empathy, not product hype.

- Best for: Products that sit between or across tools.

- Trigger: Buyer is using multiple complementary tools like Greenhouse + Slack or Intercom + Notion.

- Message: “We unify [Tool A] and [Tool B] to eliminate manual handoffs and automate [X process].”

E. Ecosystem GTM Play

Platform ecosystems are powerful. Buyers inside these ecosystems are more likely to trust (and adopt) tools recommended within the platform’s marketplace. If you’re listed on AppExchange or the Shopify App Store, that credibility matters. It tells the buyer: “We play nicely with what you already have.” Your messaging here should be trust-forward and time-sensitive: “Most teams add us within 30 days of adopting Salesforce to reduce lead routing friction and improve conversion.” Show them you belong where they already are.

- Best for: Products that go to market via marketplaces or integration partnerships.

- Trigger: Buyer is newly using Salesforce, Shopify, Workday, etc.

- Message: “We’re a top-rated AppExchange partner. Most Salesforce teams add us within 30 days to [specific outcome].”

4. The Secret Edge: Stack Install Dates and Usage Timelines

Knowing what tools a company uses is good. Knowing when they started using them is better. Install dates unlock:

- Renewal windows: Most SaaS runs on 12-month cycles. If they started Outreach in July, approach in May.

- Implementation timing: If a company added Salesforce 3 weeks ago, they’re still onboarding—great time to pitch enablement, integration, or data hygiene.

- Adoption insights: A tool added 3 years ago might be shelfware. Don’t pitch around it unless you know it’s active.

Some technographic providers expose install dates (e.g. BuiltWith, Reachfast, Wappalyzer). Use this data to segment and sequence by buyer timing, not just ICP fit.

Layering Signals for Maximum Precision

Technographics become dramatically more valuable when stacked with other signals. A company that just added Salesforce and hired a RevOps lead? That’s a warm target for enablement or analytics tools. One that just raised Series B and added Segment and Amplitude? Likely entering product-led scale and in need of data infrastructure support. Or maybe you see a company still on Marketo, but employees are engaging with competitor content– that’s churn-in-progress. Layer technographics with hiring, funding, and intent to isolate not just who to reach. But when, with what, and why. That’s when messaging feels native to their motion. And that’s how you reach inboxes that convert.

Why Most Teams Fail with Technographics

Most teams fail with technographics because they treat it like static enrichment, not a dynamic signal. They pull a list that shows “has Drift” and assume that means the account is qualified. But they don’t ask: when was Drift added? Is it active? Who manages it? What does its presence actually say about this company’s GTM motion? Then they blast the same pitch across every tool: generic copy with a {{first_name}} token and a half-baked CTA. That’s not technographic GTM. That’s warmed-over spray and pray. Execution breaks down because SDRs aren’t trained to read stacks as stories. They don’t know how to map tools to maturity stages, or how install timing maps to renewal cycles, or what signals a platform like Mixpanel implies about the org’s structure. To fix this, teams need playbooks, not just lists. They need to route messaging by stack logic. Use install dates to time cadences. And above all, build narratives that fit the reality of what the buyer is already living.

Tools to Operationalize Technographics at Scale

Here’s how top outbound teams operationalize technographic plays:

- Reachfast: Enrich LinkedIn URLs with verified contact data and active tech stack.

- BuiltWith / Wappalyzer / Datanyze: Detect web stack and installation history.

- Clay + PhantomBuster: Automate enrichment workflows and live scraping.

- SalesNav + Apollo: Combine job change, persona fit, and tech stack for targeting.

- Smartlead / Instantly: Multichannel sequencing triggered by technographic signals.

Route plays by stack. Time cadences by renewal. Personalize by workflow. This is where outbound becomes intelligent.

Closing: Tech Stack Is a Map of Buyer Needs—If You Know How to Read It

Technographics aren’t just enrichment. They’re x-rays. They let you see what a buyer already invested in, what problems that investment likely created, and where they’ll need help next. But most teams treat this insight as a checkbox: they run “has tool X” filters and write the same sequence for every outcome. That’s not how high-performance GTM works. The real value of technographics isn’t knowing what tech a company uses. It’s using that knowledge to infer stage, workflow, pain, and timing. It’s reading the stack like a storyline. It’s knowing that Gong + Clari means sales-led motion, or that Amplitude + Segment means PLG is scaling. If your outbound message matches the buyer’s current motion, it doesn’t feel like outreach. It feels like timing. Technographics let you get that timing right. Use them to show you understand not just who they are—but where they are in their GTM journey. That’s how you earn the reply. And the deal.